Governments rely on tax revenue to operate and provide basic services to citizens, but in Niger, local authorities face enormous challenges with collecting and transparently managing municipal taxes. Some citizens lack fiscal responsibility while those working to collect taxes do not always understand their roles and responsibilities.

To improve this resource mobilization issue among our partner municipalities, Counterpart’s Resilient Governance in Niger project, “Jagoranci,” collaborated with the General Direction of Decentralization and Local Authorities to organize a multistakeholder dialogue in Zinder. The dialogue brought together key stakeholders: the Minister Delegate for Decentralization, prefects, regional and departmental financial authorities, heads of cantons, mayors, the municipal receivers, and the regional delegation of the local authority financing agency. This dialogue resulted in the development of a plan and stakeholder commitments aimed at improving tax collection in the partner municipalities.

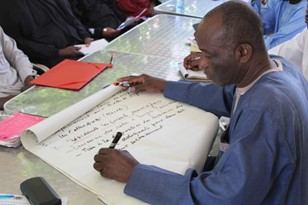

The multistakeholder dialogue in Zinder where leaders discussed ways to improve tax collection.

Five months later, Jagoranci organized a workshop in Zinder to monitor commitments by bringing together the same stakeholders who assessed the progress made by the municipalities and shared the actions they had taken. This process has already yielded significant results:

- Improved collaboration and coordination between mayors, collectors, and traditional leaders in tax collection.

- The timely payment by mayors of gratuity bonuses to village chiefs who have made a good return in the collection of municipal tax

- An increase in the municipal tax recovery rate in several communes from 2022 to January-March of 2023:

- Wacha – 27 to 80.76%

- Mallaoua – 13.96 to 28.85%

- Kwaya – 20.8 to 32.48%,

- Dantchio – 9.57 to 15.05%.

For example, in Dungass, the head of the canton brought together all the village chiefs to explain their duty to collect municipal taxes. In the commune of Wacha, village chiefs who paid the municipal tax were rewarded, and in Magaria, to incentivize citizens to pay the municipal tax, fees to certify civil registry documents, such as birth and marriage certificates, were waived once the tax payment was received.

The project continues to support communes in improving tax mobilization, including through the development of tailored resource mobilization strategies and increasing citizen awareness in various ways such as through the communal consultation frameworks.

The financial resources mobilized will strengthen the capacity of municipalities to finance their operations and improve the delivery of services to their citizens.